Deep dive on Symbotic, a leader in robotics and automation

Projected IRR 26%

Symbotic is a provider of robotics and software for the automation of warehouses. They recently won a large contract to automate all of Walmart’s distribution centers, bringing their backlog to a whopping $12 billion. This practically guarantees strong revenue growth for the coming four years. Their other clients include Albertsons, Target, Giant Tiger and C&S Wholesale Grocers.

The company’s systems manage the complete chain of warehouse operations, from the time merchandise is off-loaded from the trucks, to the storage and retrieval of inventory, to the preparation of shipments to retail stores. The platform is composed of de-palletizing robotic arms, which pick cases from newly arrived pallets; atomizing robotic arms, which put the cases in scanning tunnels; autonomous mobile robots, which store and retrieve cases; and palletizing robots that stack pallets with the needed SKUs (storage keeping units) to be shipped to the retail stores.

On the image below, the de-palletizing robotic arm is the large one on the right. It takes an entire layer of cases from a pallet at once and puts it on the conveyor belt to be sent to the next cell in the automated chain.

Subsequently, atomizing robotic arms organize the individual cases to go through a scanning tunnel, where each product’s dimensions are scanned as well as health checks being performed to check for damage. Any case that the system determines is damaged is set aside so that a human worker can inspect to either repair or reject the goods.

Upon exit from the scanning tunnel, the cases move to lifts where they’ll be brought up to the selected level in the warehouse. At each level, cases are placed onto buffer shelves where they’ll be picked up by autonomous mobile robots.

The overall warehousing structure of Symbotic’s system is composed of three feet tall levels stacked on top of each other. Each level contains a series of parallel aisles for the robots to travel to the storage locations.

The software system uses AI to determine the cases’ optimal location in order to reduce robot travelling times. Symbotic claims to have the fastest robots in the industry, travelling through the warehouse at speeds of 25 mph.

The mobile robots are automatically recharged by charge plates integrated into the floors, allowing them to work continuously. The bots are also interchangeable so if one needs to be taken out of production for maintenance, the software will assign its tasks to another one.

For shipment, the mobile bots retrieve cases and bring them to outbound lifts from where the cases are loaded onto conveyor belts. At the end of each belt, palletizing robotic arms stack the cases onto pallets, from where they are loaded onto trucks. Pallets are built according to the retail stores’ aisles so that the goods can rapidly be shelved once in store.

Below are what finished pallets look like:

The whole system is designed so that there isn’t a single point of failure. There are a multitude of robots, lifts and conveyor belts so that any task can always be taken over. Additionally, all equipment has a modular design so that components can easily be swapped on site.

Symbotic’s software provides analysis and predictions of inventory levels, throughput, system performance and maintenance needs. According to the company their platform has an accuracy of more than 99.99%.

Do me a favor and hit the subscribe button. Subscriptions let me know you are interested in research like this, which is a good motivation to publish more of the analysis I’m carrying out. Special thanks to the 400 subscribers so far!

The installed system is estimated to have a lifetime of 25 to 30 years. It can be installed in distribution centers of various sizes and shapes due to its modular design. Meaning that should the customer’s demand increase in the future, the system can be easily extended. A typical deployment takes around 6 to 12 months once the contract has been negotiated.

The company was founded in 2006 by Rick Cohen, who’s still the current CEO and Chairman. His grandfather started C&S Wholesale grocers, which he took over in 1989. Experiencing firsthand how low margin and inefficient wholesale businesses are due to high labor costs, Cohen came up with the vision to have fully automated warehouses. Over its history Symbotic has spent over $700 million to achieve this objective.

The company operates in an attractive market to be exposed to as an investor. Firstly, the penetration rate of warehouse automation is low, at around 15% globally. As a result, this market is expected to grow at double digit annual rates. Symbotic estimates that the penetration rate of automation in US warehouses is 20%, of which 15% they describe as mechanized legacy solutions. Naturally with the progress in AI and sensor technology, older systems can be replaced in the coming 10-15 years with more modern versions.

Secondly, as the main cost of operating a warehouse is labor related with the storage and retrieval of goods, payback times on investments in automation tend to be quick. Autostore, a competitor of Symbotic, mentions their customers typically get a payback within one to three years. With the high rates of wage inflation we’re currently witnessing, payback times will only have come down. Additionally, automated systems allow for large space reductions in warehousing space. Autostore mentioned that Texas Instruments was able to consolidate their four Singapore warehouses into one after installing their system. Symbotic estimates that their system reduces floor space with 30 to 60%, meaning that the typical client should be able to consolidate approximately two warehouses into one.

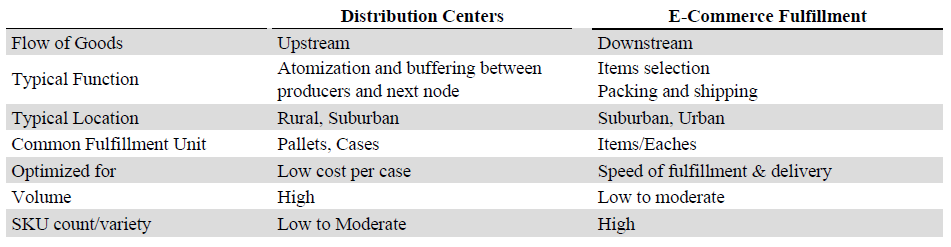

Both Symbotic and Autostore are not mentioning each other as competitors. Symbotic is currently active in automating distribution centers for retail chains such as Walmart, whereas Autostore is mostly exposed to order fulfilment for e-commerce. In a recent interview with the FT, Symbotic’s CEO discussed that Autostore is operating downstream from them. In the future, as both companies extend their capabilities, it’s likely that they will become competitors however.

Symbotic gives the following overview to differentiate between the two companies’ markets:

Symbotic estimates that their addressable market is around $8 to 16bn per annum in the United States. Over the long-term there’s naturally the opportunity for geographic expansion, although these markets can already be largely captured by competitors by then. Autostore for example already has 800 clients over Europe, North-America and Asia.

Symbotic mentions as its key competitors Witron, Honeywell, Dematic, Vanderlande, SSI, Schaefer and Swisslog. The overall robotics industry is clearly a competitive space with more than a handful of competitors. Symbotic mentions that relative to competitors, the robotic units in their system are better integrated resulting in a higher level of automation while being easier to implement. I don’t have an extensive view of the capabilities of each of these companies. However, given that Walmart decided to roll-out Symbotic’s system across all their distribution centers, I suspect that Symbotic’s system should be one of the better ones within the space.

Initially, Walmart’s orders covered installing Symbotic’s platform in 20 regional distribution centers. However, in 2022, further orders followed to have an implementation across all of Walmart’s 42 regional distribution centers. On top of that, Walmart took an 11% stake in the company. From this I take it that initial tests of the system have shown strong results.

Once a system is installed, there are annual aftermarket revenues consisting of software fees, spare parts and support services.

Symbotic makes use of a direct sales model, in contrast to Autostore which relies heavily on a distribution network of supply chain consultants. As a result Symbotic has a few large clients while Autostore has a diversified, global client base. Symbotic mentioned on their previous earnings call that they’ve started building up a network of distribution partners in Europe and Asia. This will help in growing the business as the partners take over sales generation as well as system installments, allowing Symbotic to focus on scaling up their manufacturing.

The company operates two manufacturing centers, one in Massachusetts and in Quebec. Massachusetts assembles the mobile bots while Quebec assembles the robotic arms.

Valuation - share price at time of analysis is $16

The company has a dual class shareholder structure allowing the founder to retain control. This isn’t necessarily bad, often companies led by founders tend to perform well. It’s when the third generation takes over that typically the business goes South. So watch out when Mark Zuckerberg III takes control of Meta..

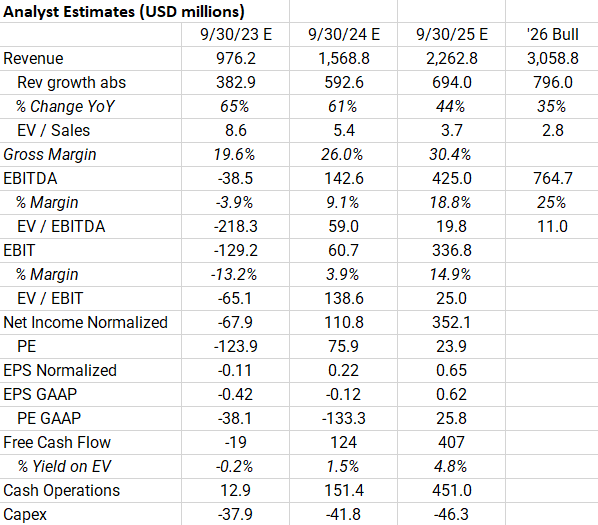

As already mentioned, one of the key attractions in this stock is the $12 billion backlog with some of America’s largest retailers. This practically guarantees strong revenue growth up to and including 2026.

Symbotic currently has 22 system deployments with multiple customers, up from 17 last quarter and 9 the year before. From this I estimate the price of one system to be around $45 million. Of the 22 deployments, 8 have started operations.

The entire implementation of the current backlog should be finished at the latest by 2029. The pricing of the contracts is structured as cost-plus, meaning that Symbotic will add a profit markup on top of the cost of implementation. This gives a natural hedge against potential raw material price increases.

The contracts can only be terminated should a client go bankrupt or if Symbotic doesn’t deliver the system at defined performance standards. However, the company mentions the latter to be an unlikely scenario.

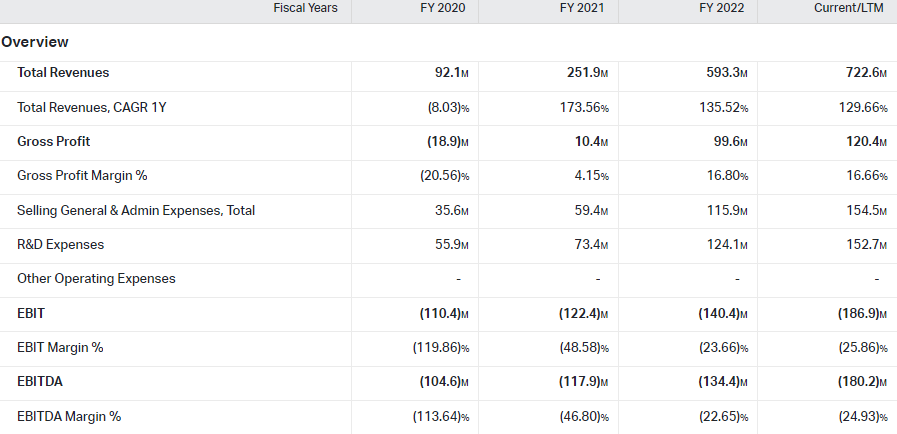

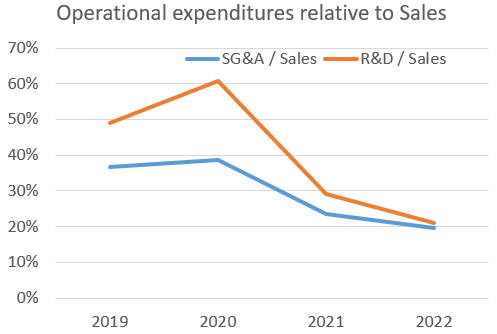

Compared to Autostore, Symbotic spends considerably more on generating sales, as well as R&D. This is logical as Autostore relies heavily on a distribution network for generating sales and is mainly focused on mobile robots, whereas Symbotic also provides in- and outbound robotic arms requiring a greater level of R&D. Gross margins are also considerably lower than Autostore’s, although they are improving strongly.

SG&A and R&D expenses have been lowered considerably relative to Sales, which has resulted in a strongly improving EBIT margin, albeit this one being still very negative at -25%.

This resulted in a negative free cash flow of $105m last year. But given that Symbotic has $450m cash on hand, there shouldn’t be much trouble getting through a possible recession. Another capital raise seems unlikely to be necessary at this stage. Only if the company wins substantially more contracts, there might be a necessity to raise more capital to invest in further growth, but in that event the shares should perform well anyways.

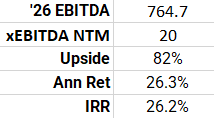

Below consensus numbers up to 2025. For 2026, given that they still have at least $7.2 billion in backlog at the start of that year, I modelled in a continued progression of rising revenues while hitting the company’s guided EBITDA margin of 25%. Given that close peer Autostore is generating EBITDA margins of 40 to 50%, albeit on a higher margin business model, 25% for Symbotic should be achievable as the business continues to scale and aftermarket revenues, which are high margin, grow in the mix.

Putting the projected ‘26 EBITDA on a 20x next twelve months’ (NTM) EBITDA multiple, gives an upside of 82% by 2025, resulting in an annual return of 26%. For comparison, Autostore is currently trading on 23x NTM EBITDA, so 20x for Symbotic looks like a reasonable multiple. As no dividends are paid out, the internal rate of return (IRR) is the same. The IRR can easily be compared with your personal risk measure, so for example, if your cost of risk is around 10% per annum, the 26% IRR is well above that meaning that the risk-reward looks attractive.

I noted that the valuation metrics in some systems for this company were wrong. The issue is that 90% of shares outstanding are Class V shares and these weren’t taken into account. So if you see a price-to-sales of 1x on this stock, that’s wrong, it’s more like 9x.

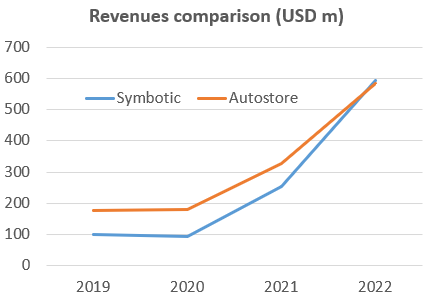

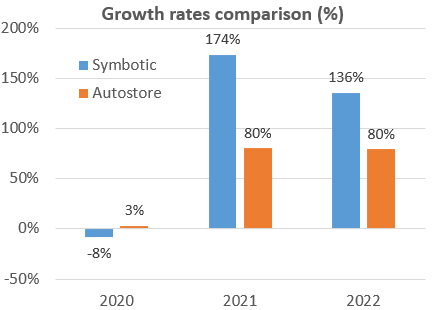

In terms of revenues Symbotic has now overtaken Autostore:

Due to higher growth rates:

Insiders have been selling the shares over the last quarters. Usually it’s a good sign to see insiders buying, however, it’s not necessarily a negative that some insiders are taking profits as they might have other personal objectives. For example, having to buy a home, sending kids to college, or a desire to diversify their assets.. I remember one of my colleagues insisting that ASML was a sell because insiders were taking profits around $75, and then some years later the shares went to $750.. Glad I didn’t listen.

However, some insider selling could actually be good for these shares as the free float is currently only at 11%. One sell side analyst commented on the last earnings call that the main pushback he’s getting from institutional clients, is that the liquidity on the shares is too low. So if one of the main shareholders, either Rick Cohen, Softbank, or Walmart, would bring more shares to the market, this could actually be a positive as it would allow the larger institutions to build a position as well, resulting in a higher valuation.

Sell side analysts are largely positive on the stock with 11 buy ratings and one hold. The average price target is $19.5.

The primary listing is on the NASDAQ under ticker SYM.

Short seller report from the Bear Cave

The Bear Cave released his bear report on Symbotic last week. However, the piece was rather underwhelming. I’ll briefly go through the main arguments.

Argument 1: the previous CEO which was meant to replace Rick Cohen left the company already after eight months. My take: it isn’t highly unusual for a CEO to clash with the owner and founder of the business. Founder Rick Cohen on the previous earnings call mentioned he’s really the Chief Product Development Officer. So I suspect he wanted to outsource some of his responsibilities by appointing a CEO. This is similar to what happened in the early stages of Tesla, Elon Musk was the chief of product development and he appointed a CEO to run other tasks. However, those two clashed as well and Musk took over as CEO. So this set-up looks to be exactly the same. I wouldn’t read too much into this at this stage unless I learn more in the future.

Argument 2: there are some very negative reviews on this company on Glassdoor. My take: nearly all companies have some very negative reviews on Glassdoor. I read through most of the reviews on Symbotic and actually most of the reviews were rather positive. Several reviewers mentioned that they were working on cool tech for example. The main complaint is having to work long hours, with several reviewers mentioning that they have to work day and night.

Argument 3: there are only a handful of competitors and the business hasn’t generated any profits so far. My take: yes, these are risks but this depends on your risk profile as an investor. If you invest in mature, profitable companies with a widely diversified clientele, it will be relatively easy to model out expected profitability and thus expected returns will be lower. Whereas if you invest in younger, high-growth companies, the risk profile is greater but also the possibility to generate outsized returns. The latter is an excellent field for stock picking.

Argument 4: there was an expert call with a former Walmart executive who stated he wouldn’t invest in Symbotic. My take: in all honesty, this ‘expert’ didn’t seem to know much of what he was talking about. He mentions for example the Walmart revenues being $10 to 20 million, whereas the actual Walmart revenues will run into the billions of dollars. He also talks about Symbotic only doing palletization, obviously this isn’t true..

As the short seller’s report was announced there was a brief panic in the market with Symbotic’s shares dropping 10%. However, as analysts read through the report it seems they shrugged their shoulders and the shares rallied the two subsequent days.

Conclusion

The main attraction here is the $12 billion backlog providing a clear path for revenue growth, as well as having a signature win with the rolling out of the system across Walmart. The 2026 projected EBITDA of $765 million looks achievable, and if they can have some further large contract wins in the coming years, a 20x NTM EBITDA for a stock like this looks somewhat conservative. This would give an attractive annual return of 26% on the shares over the coming 2.5 years.

If you’ve enjoyed reading this, hit the like button below and subscribe. Also, please share a link to the research on social media with a positive comment, it will help the publication to grow.

You can find a complete overview of all research here.

Disclaimer - This article doesn’t constitute investment advice. While I’ve aimed to use accurate and reliable information in writing this, it can not be guaranteed that all information used is of such nature. The projected IRR is a subjective calculation based on what I estimate a likely and reasonable scenario for the shares to be, however, the shares’ future performance remains uncertain and a more negative scenario could play out. The views expressed in this article may change over time without giving notice. Please speak to a financial adviser who can take into account your personal risk profile before making any investment.