Deep dive on Autostore, a leader in robotics and automation

Projected IRR 48%

Autostore is a provider of automated storage and retrieval systems (AS/RS), from the robotics to the software to the needed components to run the system on. The whole system is modular so that it can be installed in any warehouse or fulfilment center, with the possibility to scale the system up or down over time. Their biggest end-market is e-commerce at 70% of revenues and some of their most notable clients include Puma, Ikea, Gucci, Siemens, Texas Instruments, UPS, DHL, Asda, Continental and Bosch.

The group pioneered an automated cubic storage system which scores best on product density while providing high throughput. Puma mentioned the payback of their investment in the system was achieved within one year, whereas originally they were forecasting five years’ time. After Texas Instruments installed the system in one of their warehouses in Singapore, they were able to consolidate three warehouses into one as the inventory capacity of the warehouse went up fourfold. Autostore has installed their system so far with 800 clients.

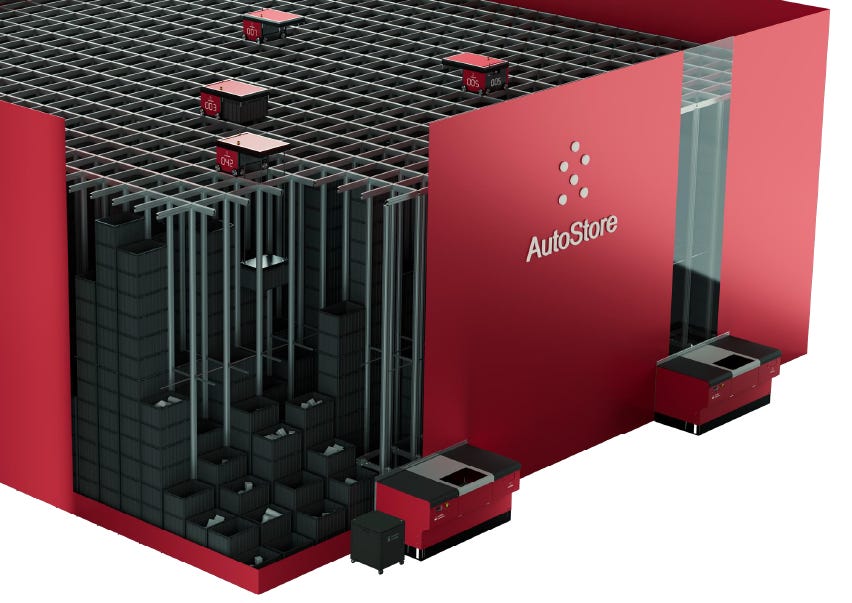

Rather than organizing products in aisles inside a warehouse, with Autostore’s system all products are placed in bins which are stacked within one dense cube. Robots drive on top of the cube, which is made from an aluminium frame, to pick bins and bring them to the ports where a human selects the right product and packages it for shipment. Multiple SKUs (stock keeping units) can be stored inside one bin as the bins can be compartmentalized. This is what the whole system looks like:

For comparison, below is what a traditional warehouse looks like – quite inefficient as 63% of costs are labor related with the storage and picking of the items.

With Autostore’s system more than 90% of the space in a warehouse can be utilized. You basically need some room at the top for the robots to move with the bins and then at the far end where the humans package the products for shipment. The system has an accuracy rate of 99.9%.

The company’s latest robots automatically swap batteries at battery stations spread around the grid when they’re starting to run on low power. This will bring the uptime of the system to 100%. With the old system the robots still had to take the occasional break to fast recharge batteries.

Each robot is controlled by the company’s software which is continuously improving with the use of AI. This means improving the algorithms to position the robots and products inside the warehouse in order to optimize retrieval times. The software runs a specialized hardware called the controller which communicates wirelessly with the robots. The controller has a two hour back-up power supply so that the whole system can shutdown gracefully should there be a power failure. Every site also has a back-up controller so the system can always keep running.

Robots spend their time driving on top of the cube to retrieve bins. When accessing lower bins in a stack, the robot will dig out bins and place them on top of nearby stacks, using the space as a temporary placeholder. Another robot will put these bins back in the stack. The latest version of the robot can stack these bins temporarily on itself so that no bins block the tracks, allowing for higher robot speeds.

After the bin is presented at the ports to the packagers, it will be placed back to the top of a stack of bins. This natural slotting ensures that highly requested products are near the top of the stacks whereas bins which aren’t frequently requested will naturally sink to the bottom of a stack. This simple algorithm results in fast retrieval times.

Each robot has a monitoring system that continuously diagnoses the robot's performance with the company’s software logging the data. If a robot needs maintenance, it can be taken out of production before any stoppages happen with another robot quickly taking over its tasks. The projected lifetime of a robot is 10 to 15 years although to date, Autostore hasn’t needed to replace any robot. This isn’t necessarily great from a business perspective, but at this stage where growth should remain strong, we don’t need to worry about a lack of aftermarket revenues.

Autostore is using their strong position in robotics to move further into software, which generates annual recurring revenues. Their recently introduced warehouse management software provides order consolidation, inventory management and labor management tools. The software is cloud-based and can connect over API (basically a programming interface which communicates in JSON-like code) with other enterprise management software such as SAP. The first large client of this system is H-Mart.

The company also introduced a cloud-based design software so that potential clients can visualize how the system will be implemented at their site.

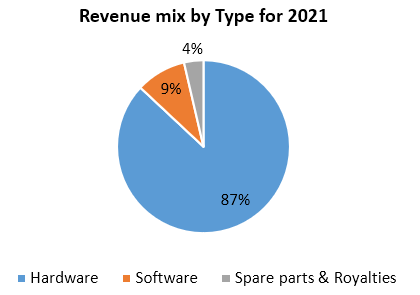

Autostore’s aftermarket revenues consists of system extensions (clients expanding their installed systems), recurring software fees, spare parts and royalties. However, at the time of IPO, recurring revenues were still a small part of the business.

Clearly what we need to focus on in the coming years is whether they can drive the growth in robotics sales. Although over the long-term software will grow in the mix as more clients and more software capabilities are added. Software is an attractive business as you can do regular price increases as the client base tends to be very sticky. This is because people don’t like to learn and install new software, especially in an enterprise environment where the software cooperates with other systems.

Autostore’s system can be reasonably quickly set-up, it takes around 3 to 9 months for an initial installation and any extension after can be done in 1 week to a half year. The typical payback on the investment for the client is within one to three years.

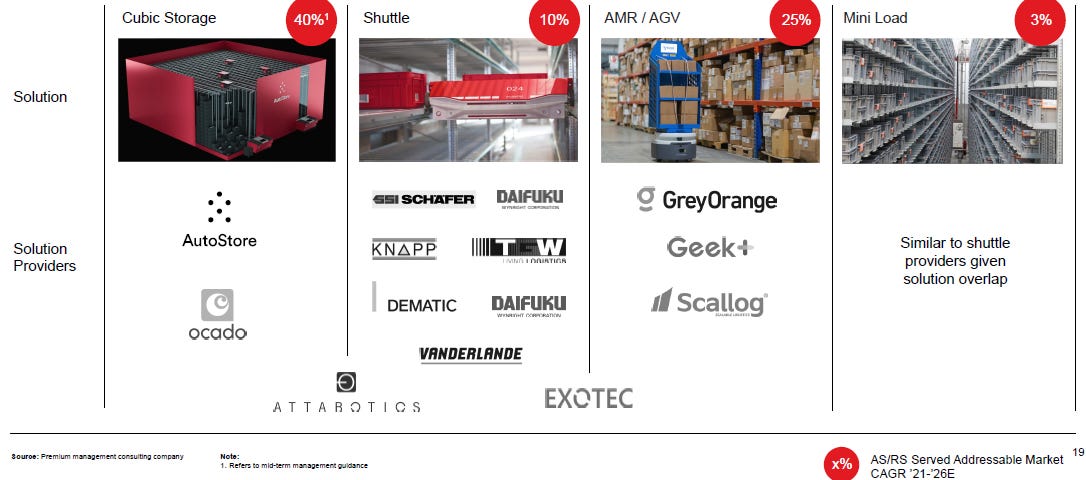

There are currently three other types of solutions to automate warehouses, besides the cubic system which Autostore provides. Autostore believes their cubic system has a market share of around 11% of the installed base and expects further share gains due to the mentioned advantages of storage density, extensibility and throughput. There are two other small competitors offering a cubic solution, Ocado and Attabotics, but they have only around 2% of the number of installations compared to Autostore.

Do me a favor and hit the subscribe button. Subscriptions let me know you are interested in research like this, which is a good motivation to publish more of the analysis I’m carrying out. Special thanks to the 400 subscribers so far!

The key competing solution are shuttle systems. In the shuttle solution, products are stored in bins in racks with shuttles retrieving them. Its throughput is superior to that of Autostore, however the trade-off is that there’s more empty space which can’t be used for product storage. Storage density is especially key in urban fulfilment centers for same day delivery which is where most of the growth is. Autostore also mentions the shuttle system to be more expensive than their solution.

Shuttle currently has a 72% market share of the installed base as it was the first automated solution available. However growth is much lower. Whereas Autostore’s cubic system has been growing at an annual rate of 49% over the last five years, shuttle has only been growing at a rate of 10%.

AMRs are ground-bound robots that transport racks to picking stations. While the upfront cost to install such a system is low as you only need to buy the robots, it isn’t designed for high-throughput operations such as e-commerce. Additionally there’s also more wastage with empty space. They are however a good solution to add automation to lower throughput warehouses. As such this type of system isn’t really in competition with Autostore. AMR currently has a market share of 11% and is expected to gain share as well as it is growing at twice the rate relative to shuttle.

Mini load is used for the retrieval of heavy products. It’s a slow system and as such isn’t in competition with Autostore as well. Mini Load currently has a market share of 6%.

Below is an overview of the competitive space. The red balloons next to each type of system are the forecasted annual growth rates. So Autostore is forecasted to grow at 40% per annum, shuttle at 10% and AMR at 25%.

Another company I’ve been researching is Symbotic, which closed a huge deal with Walmart earlier in the year. However, both Symbotic and Autostore are not mentioning each other as competitors. Symbotic is currently active in automating warehouses for retail chains such as Walmart and Target, whereas Autostore is especially exposed to order fulfilment for e-commerce. In a recent interview with the FT, Symbotic’s CEO discussed that Autostore is operating downstream from them.

However, as both companies expand their capabilities it seems likely that in the future they’ll become competitors. I do suspect there is a certain amount of overlap between their businesses already. But they might prefer to give the impression to the market that both companies have a unique, superior automation offering which no competitor comes close to.

Autostore’s major end-market of e-commerce is growing at an annual rate of 16% and is expected to reach a penetration level of around 24% of the wider retail market by ‘25. In a recent survey, nearly three quarters of consumers reported to be planning to shop online more frequently in the future.

Historically, consumers expected online orders to be delivered within three days but today that has moved to one day delivery. In a recent survey of people under 25, more than half stated that same-day delivery was their most important decision factor for who to shop with online. Clearly the trend is towards consumers desiring ever faster delivery for online purchases. Two hour deliveries could become the norm in large cities down the road.

This results in an increased demand for smaller, urban fulfilment centers, also called micro fulfilment centers or MFCs, in close proximity to the end consumers. MFCs are expected to grow at a 50% annual rate in the near future as they’re currently only 3% of the overall market. So there’s plenty of scope for growth here.

The current penetration level of automation in the overall warehousing market is 15%. The demand for automation solutions is expected to grow at an annual rate of 18% in the coming years. Autostore estimates that within their top 10 customers, they have a penetration rate of less than 5%. So there’s a large potential to expand operations.

Autostore partners with a distribution network of supply chain consultants, who push Autostore’s products to their clients, although not exclusively. The company is now working with 33 distributors globally. Examples include Softbank Robotics and Samsung.

The company also recently introduced a pay-per-click revenue model, so that the customer has a reduced upfront payment and then pays based on how many orders the platform is running. There’s a minimum fee included so that Autostore always secures a positive cash-flow on the business.

Most of Autostore’s business is in Europe and especially Germany, but both North-America and Asia are expected to continue to grow at faster rates. So the revenue mix should become more balanced in the future geographically.

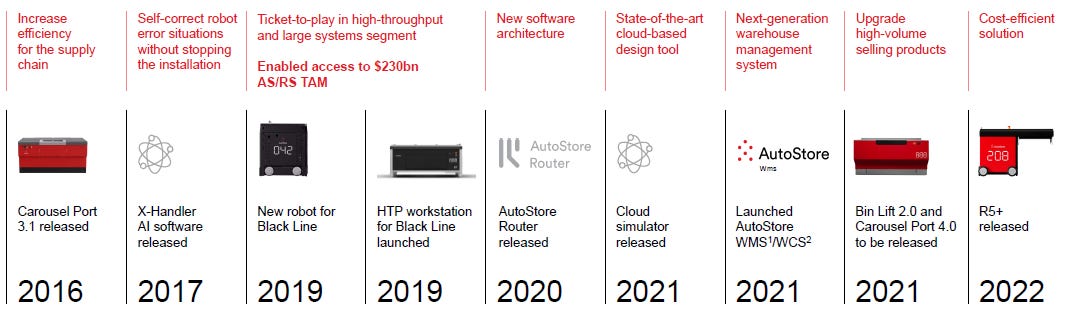

The company is also significantly expanding in R&D, the number of engineers grew from 49 employees in 2017 to 160 in 2022. They’re obtaining over 100 patents per annum currently. Below is an overview of the team’s recent key developments.

Next they’re working on having the system operate in a frozen environment, for which there is high demand from e-grocery. They expect to make the first installment of such a system this quarter. So this should become a new growth driver.

For every component the company uses in assembly, there are several suppliers, which incentivizes them to compete on price. For example, to supply the aluminium grid components, there are now 14 certified suppliers.

Autostore recently made some price increases on the whole range of their products. In the last quarter of ’21 they raised prices with 7.5% and then another 5% price increase during ‘22. This was due to the input cost inflation the company had been seeing and which was putting pressure on the gross margin.

Valuation - share price at time of analysis is 21.5 NOK

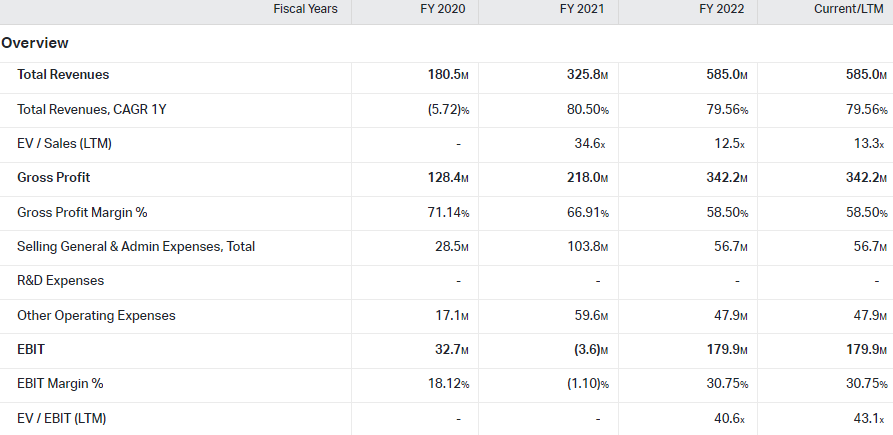

The company has been generating strong growth and is now generating attractive operating margins of 34%. R&D expenses for 2021 were $15m or 5% of revenues which seems a bit low. On the one hand it’s impressive what they’ve achieved with such a small engineering team. On the other, a large R&D budget provides a substantial barrier to entry for competitors, or at least gives the perception to investors.

The margin decline in ‘22 was due to the impact of input cost inflation but this should recover as from this year due to the price hikes the company made one year ago. There’s a time lag between contract negotiations and installments so it takes around 12 months at least to see a full recovery in the margin.

The long term historical growth profile has been solid with a CAGR of 53% and an adjusted EBITDA margin of around 50%. The company commented to have made strong market share gains as they are growing at a rate of 2-3x relative to their market.

However, the recent order intake profile is less rosy. Clearly as from the first quarter of 2022 order growth has stagnated. I suspect this is due to the strong boom in e-commerce which we witnessed during the lockdown years with a subsequent downsizing of activities as from 2022 as the industry had over-invested (based on news reports). So the demand for equipment should have been in a negative cycle, and with the share gains Autostore made they’ve managed to keep order flow flat. Or at least that’s how I can make sense of the data. The company also commented that over the last two quarters they’ve started noticing the weak macro environment in their discussions with clients i.e. they’re seeing more hesitancy to invest due to concerns for a recession.

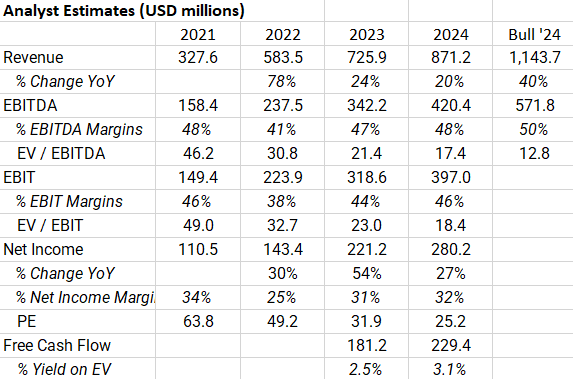

Autostore’s medium term guidance is to continue to grow at an annual rate of 40% with the adjusted EBITDA margin returning to around 50%. Sell side analysts are modelling in a more conservative growth profile of around 22% for the coming two years. Which I suspect is due to the mentioned macro concerns. The modelled margin increases in ‘23-24 are due to the price hikes the company made during the last 15 months and which will now start to become visible in revenues. The bull ‘24 scenario below is where the company hits their guidance of 40% annualized growth while bringing the EBITDA margins to 50%.

On consensus ’24 numbers, the shares are valued at 17x EBITDA, 18x EBIT, a PE of 25x and a FCF yield of 3.1%. For comparison, peers like ABB and Schneider trade at next twelve months multiples of 13x EBITDA and 19x EPS while not producing much growth.

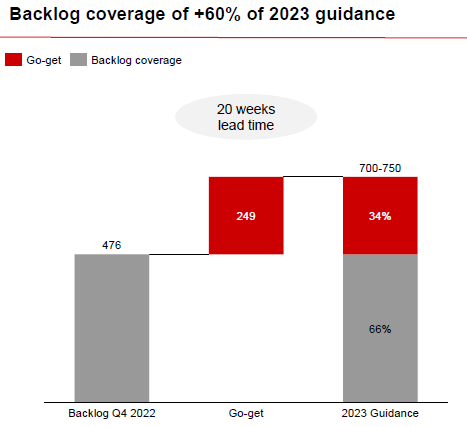

However, the sell side’s numbers look conservative as the current backlog covers already 60% of ‘23 revenues. So if you take a quarterly order flow of around $150m for the next two quarters, which they have been doing over the last seven quarters, you get to at least $776m in ‘23 revenues, which would beat sell side estimates by at least 7%. So the sell side is clearly pricing in a slowdown due to the macro environment.

A potential tailwind I’m seeing is that with the rise in wage inflation, order flow could start seeing again growth as from this year, as companies decide to bite the bullet on capex and invest in Autostore’s system to reduce their exposure to labor costs.

In a recent survey carried out by Autostore amongst 300 executives, 88% of respondents were planning to implement automation solutions by 2024. Only 32% of those surveyed had so far implemented some level of automation already. The key cited concern was rising energy costs, followed by rising labor costs and supply chain constraints.

Below is a calculation of what the annual returns would look like if growth returns and the company executes on their guidance. If ‘24 EBITDA is valued on a 19x next twelve months’ multiple (vs 21.4x currently) by early ‘24, this would give a return of 48% over the next twelve months.

Below is the EV / EBITDA NTM multiple since IPO:

The shares were weak following the ‘21 IPO, followed by a bottom mid ‘22. Currently, sell side analysts are mixed on the stock with two sell recommendations, two holds and five buys.

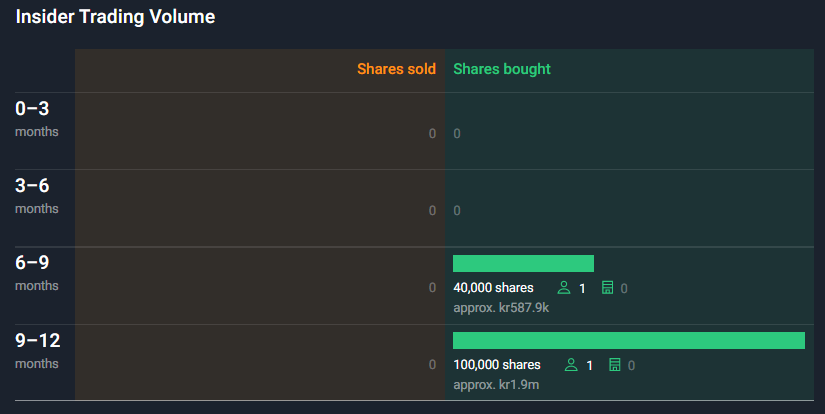

When the shares were weak twelve months’ ago, one insider bought a substantial position:

The main listing is on the Oslo stock exchange (Norway) under ticker AUTO.

Conclusion

The shares look reasonably valued under a more conservative scenario such as those modelled out in consensus numbers. This provides downside protection in the share price. Whereas should the company be able to execute on their guidance and we see an increased demand for automation over the coming 24 months, there’s clearly strong potential upside. This makes the risk-reward look attractive. I’m buying a position here and will add to the shares on weakness.

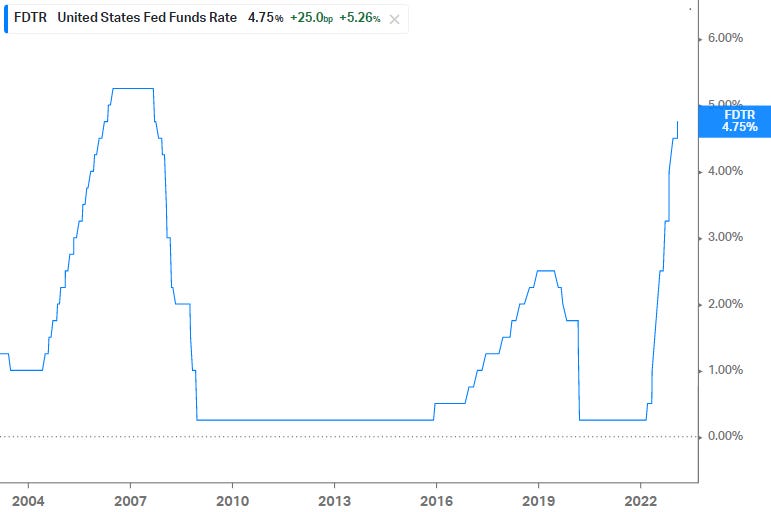

Note also that with the fed funds rate likely to go to 5.25 to 6% in the coming months, the probability is reasonable that at some stage, something is going to break in the economy. This should trigger a sell-off in the market followed by central banks reversing course and cutting rates. So I’m keeping a substantial part of my portfolio in cash and short term bonds at the moment, which can then be allocated to further stock picks down the road.

If you’ve enjoyed reading this, hit the like button below and subscribe. Also, please share a link to the research on social media with a positive comment, it will help the publication to grow.

You can find a complete overview of all research here.

Disclaimer - This article doesn’t constitute investment advice. While I’ve aimed to use accurate and reliable information in writing this, it can not be guaranteed that all information used is of such nature. The projected IRR is a subjective calculation based on what I estimate a likely and reasonable scenario for the shares to be, however, the shares’ future performance remains uncertain and a more negative scenario could play out. The views expressed in this article may change over time without giving notice. Please speak to a financial adviser who can take into account your personal risk profile before making any investment.

Have you added to your shares on weakness? It looks like THL and Softbank are getting ready to reduce their holdings. The business also accelerated recently.